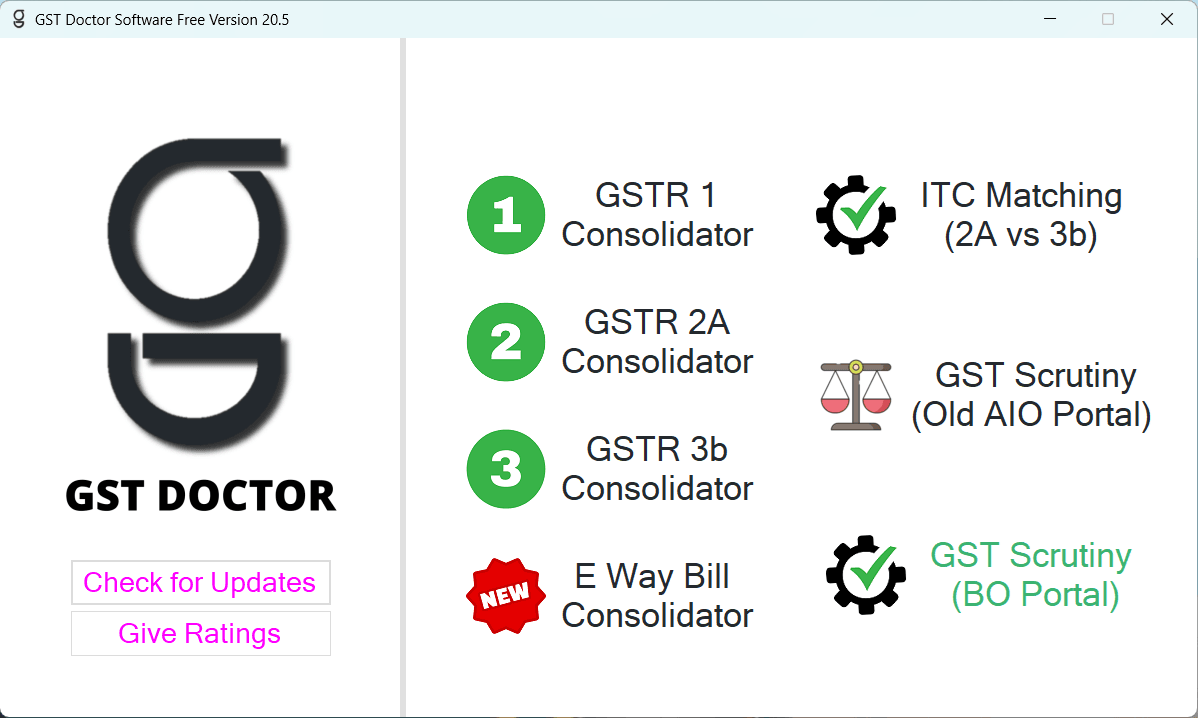

GST Doctor Software

MultiYear GST Returns Consolidators now available. Please update the GST Doctor Software to Version 26. Click to purchase the software if you havent already.purchase

Every regular taxpayer with turnover above a certain limit files GSTR-1 and GSTR-3B every month and gets auto-populated GSTR-2A/2B. Some are also required to file GSTR-9.

- GSTR 1: Invoice wise Sales Data

- GSTR 2A/2B: Invoice wise Purchase Data (use GSTR-2B for instant download)

- GSTR 3B: Summery of Sales and Purchase ITC (use GSTR-3B for instant download)

- GSTR 9: Final Annual Return with corrections (use Filed Return not System Computed Return)

GST Doctor Software can be used for analysis of these returns filed by the taxpayers in an efficient and time-saving manner.

Software Support

| Feature | CGST Officers (BO Portal and AIO Portal) | SGST Officers (BO Portal) | Taxpayers (gst.gov.in) |

|---|---|---|---|

| Invoice-wise ITC Matching | ✓ | ✓ | ✓ |

| Scrutiny of GST Returns (GSTR 1 vs 3b vs 2A/2B vs 9) | ✓ | ✓ | x |

| GSTR-1 Consolidation | ✓ | ✓ | x |

| GSTR-2A/2B Consolidation | ✓ | ✓ | ✓ |

| GSTR-3B Consolidation (excel/zip/pdf) | ✓ | ✓ | x |

| E-Way Bill Consolidation (MIS Portal Inward and Outward Supply) | ✓ | ✓ | ✓ |

Software Features

| GST Doctor Software Features | Free Version | Pro Version |

|---|---|---|

| Sheetwise GSTR-1 Consolidation with Summary | ✓ | ✓ |

| Detects GSTR-1 Invoices uploaded in wrong month (for interest) | ✓ | ✓ |

| Sheetwise GSTR-2A/2B Consolidation with Summary | ✓ | ✓ |

| GSTR-3b Consolidation | ✓ | ✓ |

| Extended due date of GSTR-3B | ✓ | ✓ |

| Auto Interest Calculation in GSTR-3B | ✓ | ✓ |

| GSTR-1 vs GSTR-3B | ✓ | ✓ |

| GSTR-2A/2B vs GSTR-3B | ✓ | ✓ |

| Complete Scrutiny of GST Returns (GSTR-1 vs GSTR-3B vs GSTR-2A/2B vs GSTR-9) | x | ✓ |

| ITC Invoice-wise matching | Limited Invoices | ✓ |

| E-Way Bill Consolidation | ✓ | ✓ |

Scrutiny of GST Returns using GST Doctor Software

Scrutiny of GST Returns (GSTR 1 vs 3b vs 2A vs 9) will now take less than a minute. Just upload-

- All GSTR-1 excel/zip files

- All GSTR-3B pdf/excel/zip files

- All GSTR-2A/2B excel/zip files

- The GSTR-9 pdf file (use Filed Return not System Computed Return)

after that click reconcile followed by download.

To learn how to download the correct format of GST returns from GSTN BO Portal, please follow the BO Portal Returns Downloading Guide.

The Scrutiny Report excel file contains more than 20 sheets having details and summary of all the returns uploaded in a readable format. It also contains comparative study of returns that can be matched with each other.

ITC Matching using GST Doctor Software

The software is specially designed to match GST ITC data invoice-wise. We can match any combination of files depending on what kind of results we want. Here are some examples:

| S.No. | What to Match | Why to Match |

| 1 | ITC Data vs GSTR 2A/2B (B2B and Debit Notes) | For ITC Verification (Not in 2A, Duplicate, Tax Mismatch etc.) |

| 2 | ITC Data vs GSTR 2A/2B Credit Notes | For finding out invoices on which ITC was taken and credit note was also issued. (For Reversals) |

| 3 | Imports Data vs GSTR 2A/2B (IMPG*) | For matching BOEs with auto populated data and greening if the IGST Value is taken as credit not Customs Duty (Look for Tax Mismatch) |

| 4 | ITC Reversal Data vs ITC Objection | If the Taxpayer has already reversed ITC through DRC-03 or GSTR 3B, get the invoice wise data and match with our ITC Objection (Not in 2A, Tax Mismatch, Duplicate etc. from S. No. 1 and other Blocked Credits under section 17(5). |

| 5 | ITC Reversal Data vs 2A Credit Notes | After selecting the credit notes for reversals (from S. No. 2) match with already reversed ITC Data (DRC-03 or GSTR 3B) |

| 6 | GSTR 2A RCM Invoices vs RCM Payment in 3B | If GSTR 2A populated RCM is more than what is shown in GSTR 3B, we can match the data to find out which invoices were left out and ask clarification regarding the same. |

Input File Format for ITC Matching

The software accepts Two Excel Files in .xls and .xlsx format for matching. The files must have 6 columns in this order-

| GSTIN OF SUPPLIER | INVOICE NO. | INVOICE DATE | IGST | CGST | SGST |

| 33AAAAA0000A1Z0 | GST-01/2017 | 21/12/2021 | 0 | 6000 | 6000 |

Please covert both files ITC Data and GSTR 2A in this format by deleting unnecessary columns and upload in the software.

Note 1: If you are using it to match Imports Data use GSTIN as AAAAAAAAAAAAAAA (15 times A) in place of GSTIN and BOE No. and BOE Date in in place of Invoice No. and Invoice Date. Put IGST at IGST column and put CGST, SGST as 0, 0. Do this in both the files Imports Data as well as 2A IMPG.

Note 2: If your file also contains Cess, then please add all taxes (CGST+SGST+IGST+CESS) and use it in IGST Column and keep CGST and SGST as 0. Do this in both the files and do the matching.

Matching Result Format

Once the matching is complete and result file is downloaded, Each ITC entry has the “matching flag” and the corresponding matched data from 2A is shown right next to it for easy comparison.

| Flag | Action Required |

| Fully Matched | No Action Required |

| GSTIN Mismatch | No Action Required |

| Invoice No Mismatch | No Action Required |

| Invoice Date Mismatch | No Action Required |

| Tax Mismatch | If ITC > 2A, ask for reversal else if ITC < 2A OK (maybe some part of invoice is blocked credit) |

| Tax Head Mismatch | CGST + SGST has been taken as IGST or vice versa, take appropriate action |

| Weak Match | Check manually and verify whether or not it can be allowed. |

| Debit Entry | Negative entries, reversal made in books, use it for Reversal Matching later |

| Duplicate Invoices | Invoices that are taken twice, ask for reversal |

| Negligible | Invoices with tax less than 5 Rs |

| Not in 2A | Invoices not reflecting in GSTR-2A of the Taxpayer, ask for reversal |

Similarly, for invoices in GSTR-2A one flag is assigned in MATCHED? column “Y” or “N”, where “Y” means it has been matched with some ITC Invoice and “N” means it has still not been matched and can be matched manually afterwards.

ITC Matching use cases for Taxpayers

Pivot ITC Invoices – Check this box if the supplier has taken ITC on same invoice in multiple parts. It will merge all the invoices having same GSTIN, Invoice No and Invoice Date placed one after another. Usually, it is recommended to green this box.

Faster Matching – Check this box if the matching data is large and your System is slow. It will not provide GSTIN-WISE summery.

E-Way Bill Consolidator

Month-wise and Region-wise E-Way Bills list can be downloaded from E-Way Bill Portal and browsed into this software for consolidation.