Matching of claimed ITC | GSTR-2A/B vs GSTR-3B

MultiYear GST Returns Consolidators now available. Please update the GST Doctor Software to Version 26. Click to purchase the software if you havent already.purchase

GST Doctor on Sun May 28 2023

ITC Claimed by the taxpayer has 3 major components i.e. Imports, RCM and All other ITC. Imports can be matched with Bill of Entry document issued by customs and RCM Credit can be matched with the RCM payments made by the taxpayer in GSTR 3B. “All Other ITC” can be matched with GSTR-2A/2B.

Relevant Section: Section 16(2)(c) of CGST Act 2017

Relevant Section: Section 16(2)(aa) of CGST Act 2017 inserted by Finance Bill 2021

Relevant Section: Section 42 of CGST Act 2017

Relevant Rule: Rule 36(4) of CGST Rules 2017

For the verification of “All other ITC”, we need the following documents:

- GSTR 2A (B2B and CDN) and for large units also check (B2BA and CDNA) – Officers must download this data from GSTIN Portal using SSO ID and password for authenticity.

- Invoice wise breakup of “All other ITC” reported in GSTR 3B-Table 4(5). Data must include certain basic details:

Supplier Name | GSTIN of Supplier | Invoice No. | Invoice Date | Taxable value | IGST | CGST | SGST | Month of taking credit

First thing you should do after getting the data from the taxpayer is create a pivot table in excel (or use filter) and check that the breakup provided by the taxpayer matches the total “All other ITC” reported in GSTR-3B for that month. If it does not match, ask the data again and if it matches do the following steps:

- Matching of ITC invoices (3B breakup) with the invoices reflecting in GSTR 2A

- Ineligible/blocked credit (even if it is reflecting in GSTR 2A)

- Whether full payment of ITC invoices has been made within 180 days to the supplier. (CGST Rule 37)

- Credit Notes reversal (reflecting in GSTR 2A CDN and CDNA)

In this article, we will focus only on step 1. For information on other steps, click the respective links.

Matching of claimed ITC with GSTR-2A

We will be matching the ITC invoices with GSTR-2A invoices on the basis of 6 columns:

GSTIN of Supplier | Invoice No. | Invoice Date | IGST | CGST | SGST

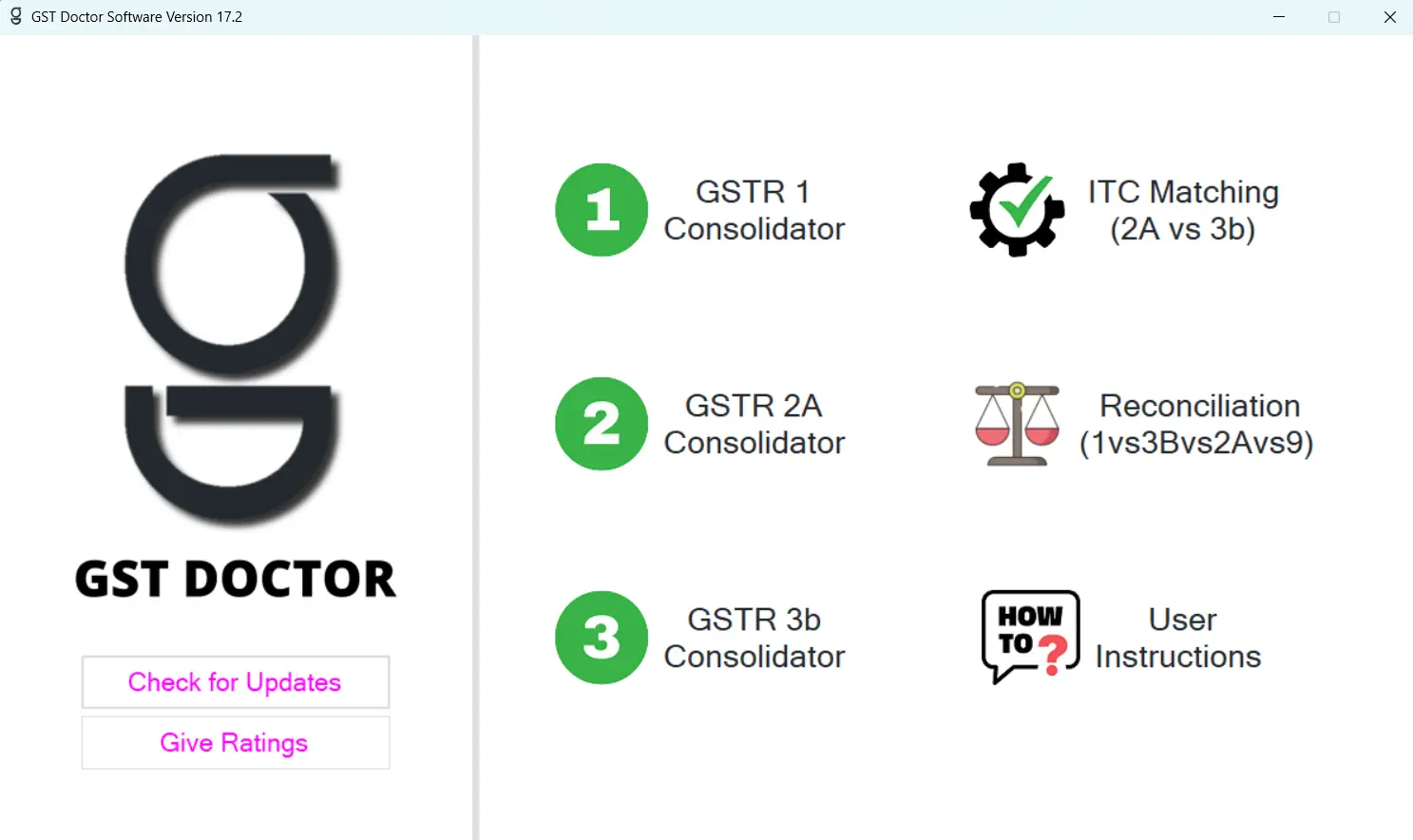

We will be using GST Doctor ITC Matching Software which is available on Microsoft Store for windows 10. The benefit of using this software is that unlike excel, it is specifically designed for the purpose of matching ITC. So, it understands the requirements and matches the invoices even after common typing mistakes and also takes care of other issues such as duplicate invoices. After matching the summery of the matching result will look something like this:

| Category | No |

|---|---|

| Fully Matched | 93063 |

| GSTIN Mismatch | 2783 |

| Invoice No Mismatch | 6399 |

| Invoice Date Mismatch | 656 |

| Tax Mismatch | 3125 |

| Weak Match | 11593 |

| Debit Entry | 1436 |

| Duplicate Invoices | 861 |

| Negligible | 5 |

| Not in 2A | 100 |

To see detailed information about these heads, you can go to the sheet “ITC vs 2A” and filter any of the heads. We are mainly concerned about the invoices “Not in 2A”, “Tax Mismatch” and “Duplicate”.

How to use GST Doctor ITC Matching Software

Step 1) Download and launch the Software.

Step 2) Upload ITC Excel File and GSTR-2A Excel file using the respective buttons.

Step 3) Click Start Input Matching button and wait for the program to complete.

Step 4) Download the Result Excel File which includes 5 Sheets:

- ITC vs GSTR 2A side by side comparison. (Use Filter on this sheet)

- GSTR-2A uploaded by the user (with information on what ITC is not taken)

- GSTIN wise Matching

- Abstract of the comparison

- Details of book adjustments (reversals made)

Disclaimer: All the information on this website is published in good faith and for general information purpose only. Any action you take upon the information you find on this website (gstdoctor.com), is strictly at your own risk.

Comments

Milan Tiwari on Mon Jul 17 2023

Now you can also use ITC Matching Tool online on https://gstdoctor.com/tools/gst-itc-matching