GSTR-1 vs GSTR-3B vs Books of Accounts

MultiYear GST Returns Consolidators now available. Please update the GST Doctor Software to Version 26. Click to purchase the software if you havent already.purchase

GST Doctor on Mon Apr 24 2023

One of the most important parts of GST Audit is Sales Reconciliation. To verify that total sales made has been correctly reported in GSTR-1 and correct tax has been paid in GSTR-3B, we need to compare GSTR-1 vs GSTR-3B vs Books of Accounts.

Since both GSTR-1 and GSTR-3B are filed monthly, we need to first consolidate them for whole year. After that we have to check whether the consolidated data is matching with each other.

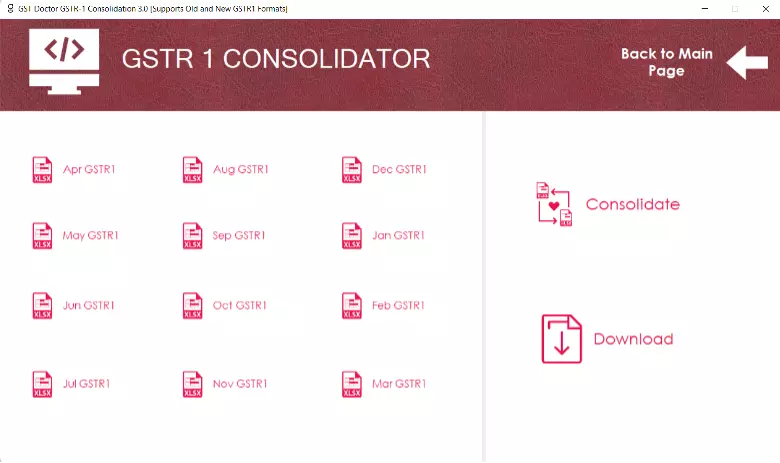

Consolidation of GSTR-1

If you are a GST Officer and have downloaded GSTR-1 from GST AIO Portal, you can use the GST Doctor Software that also consolidates GSTR-1 excel files. Just open the software after installation and click GSTR-1 Consolidator and you see this window on the software.

The downloaded consolidated file has the invoice wise consolidated sheets such as B2B, B2CS, CDNR, SEZ, EXPORTS etc. We will use this data while comparing with GSTR-3B.

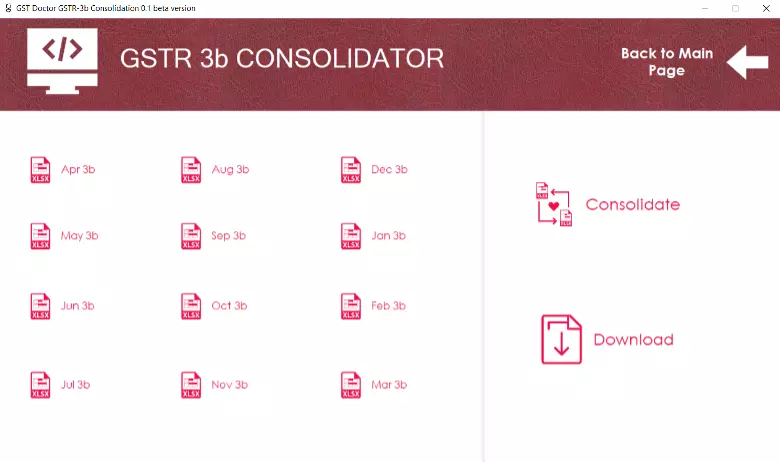

Consolidation of GSTR-3b

If you are a GST Officer and have downloaded GSTR-3b from GST AIO Portal, you can use the GST Doctor Software that also consolidates GSTR-3b pdf files. Just open the software after installation and click GSTR-3b Consolidator and you see this window on the software.

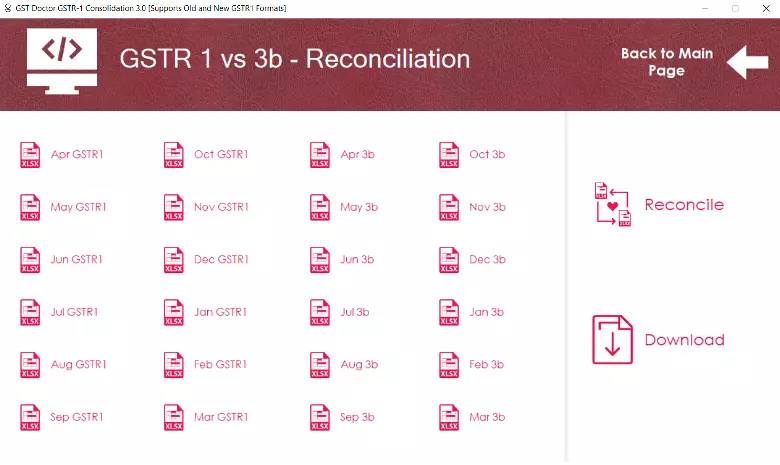

Reconcile GSTR 1 vs 3b

If both the GSTR 1 and GSTR 3b are downloaded from GST AIO Portal, you can use our new feature in GST Doctor Software that will automatically consolidate as well as reconcile GSTR 1 and GSTR 3b. Just open the software after installation and click Reconcile GSTR 1 vs GSTR 3b and you see this window on the software.

GSTR-1 vs GSTR-3B vs Books of Accounts

After consolidation of GSTR-1 and GSTR-3B we will have to match this value with sales reported in Balance Sheet/ Trial Balance. If the sales reported in GSTR-1 and GSTR-3B is less than the sales reported in Books, you have to ask for Tax on the remaining amount. For the purpose of calculation of Rate of Tax on this amount you can see what rate is attracted by major supplies from that taxpayer and derive Tax Rate from there.

For matching Outward taxable supplies (other than zero rated, nil rated and exempted) reported in GSTR-3B with GSTR-1, our software uses this formula:

GSTR-1 (B2B + B2C – GST Credit Notes + GST Debit Notes) = Table 3.1(a) of GSTR-3B

Suppose the value does not match and there is a difference. Here are the possible cases.

Case I: GSTR-1 and GSTR-3B is matching but Books of Accounts is not

In this case you have to ask the taxpayer to explanation as to why he has underreported/overreported the values in GST returns. There can be multiple valid reasons for that. For example, if there is an inter-state stock transfer then they have to show it in the GSTR-1 and pay the Tax in GSTR-3B while they will not mention it as sales in their Balance Sheet. If the tax amount in Books in more and taxpayer in unable to explain as to why this sale is not reported in GST returns, officers may ask the taxpayers to pay the GST on the surplus amount.

Case II: GSTR-1 and GSTR-3B itself is not matching

In case when GSTR-1 and GSTR-3B is not matching and GSTR-1 is more than GSTR-3B then the taxpayer should pay the tax on surplus amount or if it is due to incorrect filing to GSTR-1 then GST Credit Notes should be issues in subsequent period as the Credit has been passed on and will reflect in GSTR-2A of the receiver.

If tax paid in GSTR-3B is more than the sum of invoices declared in GSTR-1 then we must check the Debit notes etc and if still there is a positive difference GSTR-1 and GSTR-3B, we need to examine the reason for that.

Disclaimer: All the information on this website is published in good faith and for general information purpose only. Any action you take upon the information you find on this website (gstdoctor.com), is strictly at your own risk.

Comments

Jayadev Singh on Mon Mar 04 2024

A tax officer, how to upload the excel or pdf file. please guide me. 9831916898